The Importance of Strategic Acquisitions in Tech Companies

Summary

In this article, we discuss the strategic value of acquisitions for large tech companies like Google. We use the example of Google’s hypothetical acquisition of Vidd to explore how companies justify valuations. We also discuss the importance of buying startups as insurance policies against potential threats to the core business. Finally, we explore the importance of technology in building successful communication platforms.

Table of Contents

- The Strategic Value of Acquisitions

- Buying Startups as Insurance Policies

- The Importance of Technology in Communication Platforms

The Strategic Value of Acquisitions

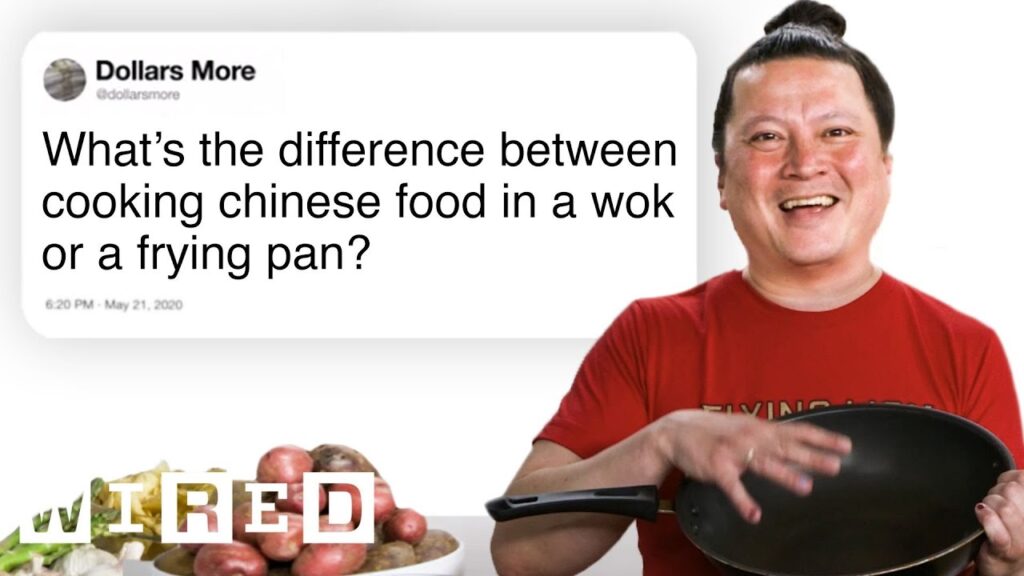

Large companies like Google use detailed models to justify the valuations of startups they acquire. The focus is not on the current revenue of the startup, but rather on how the acquirer can monetize it. For example, Google’s acquisition of YouTube was a success because they were able to monetize the platform with advertising.

In addition to financial gain, acquisitions can also provide strategic value to companies. Acquiring a startup can give a company access to new technology or talent that they may not have been able to develop in-house. It can also help the company stay ahead of potential threats to their core business.

Buying Startups as Insurance Policies

Companies that fail to buy insurgents before they disrupt the market risk falling behind. For example, Kodak and Borders failed to buy the insurgents in their respective markets and ultimately went bankrupt. Nokia and RIM could have benefited from buying modern operating systems like Android and Palm.

Acquiring startups can act as an insurance policy against potential threats to the core business. It allows companies to stay ahead of the curve and adapt to changes in the market.

The Importance of Technology in Communication Platforms

Building successful communication platforms requires deep technical expertise. Companies often underestimate the complexity of these systems and the value of the back-end technology that supports them.

The speaker in the interview uses the example of Twitter to illustrate this point. The value of Twitter is not just in the individual apps, but in the back-end systems and network capabilities that support them. Companies should invest in the technology behind these platforms, even if it seems unnecessary at the time, because shifts in the market can happen quickly.

In conclusion, strategic acquisitions can provide financial and strategic value to tech companies. Acquiring startups can act as an insurance policy against potential threats to the core business. Finally, building successful communication platforms requires deep technical expertise and investment in the back-end technology that supports them.